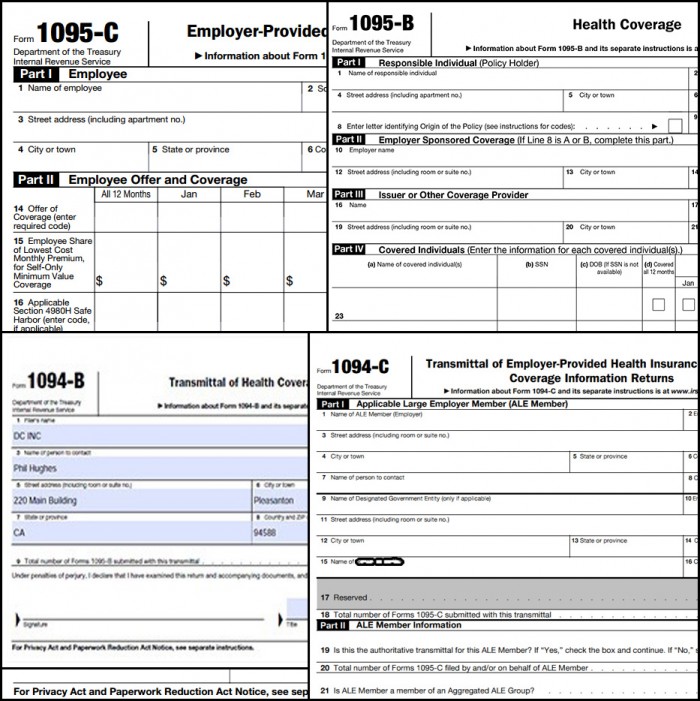

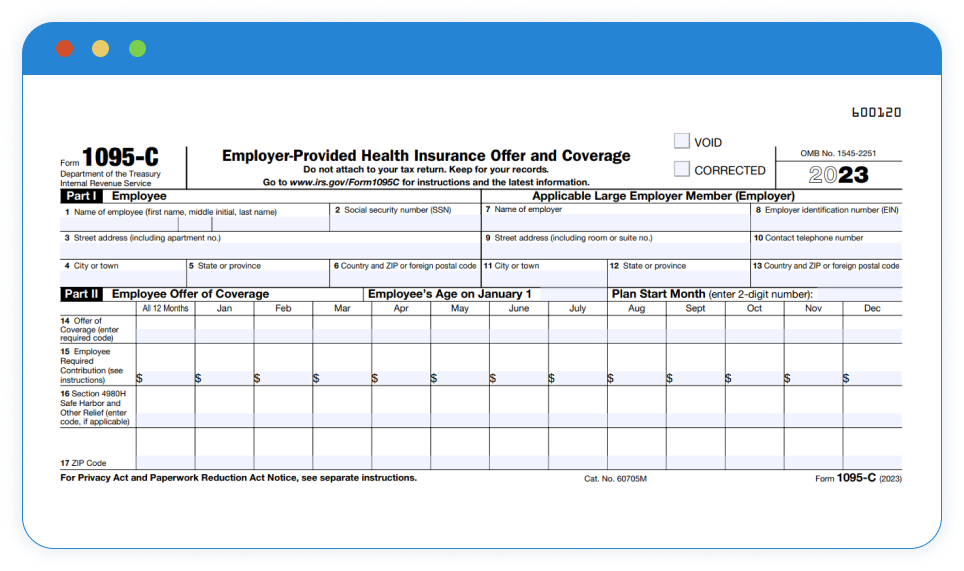

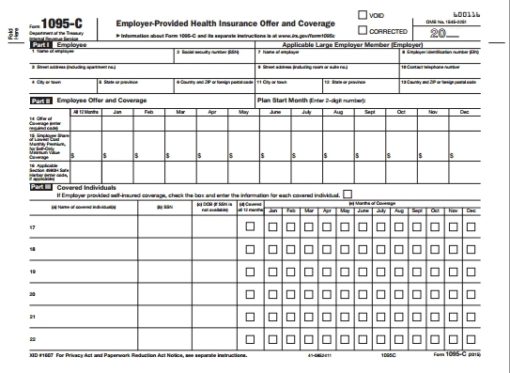

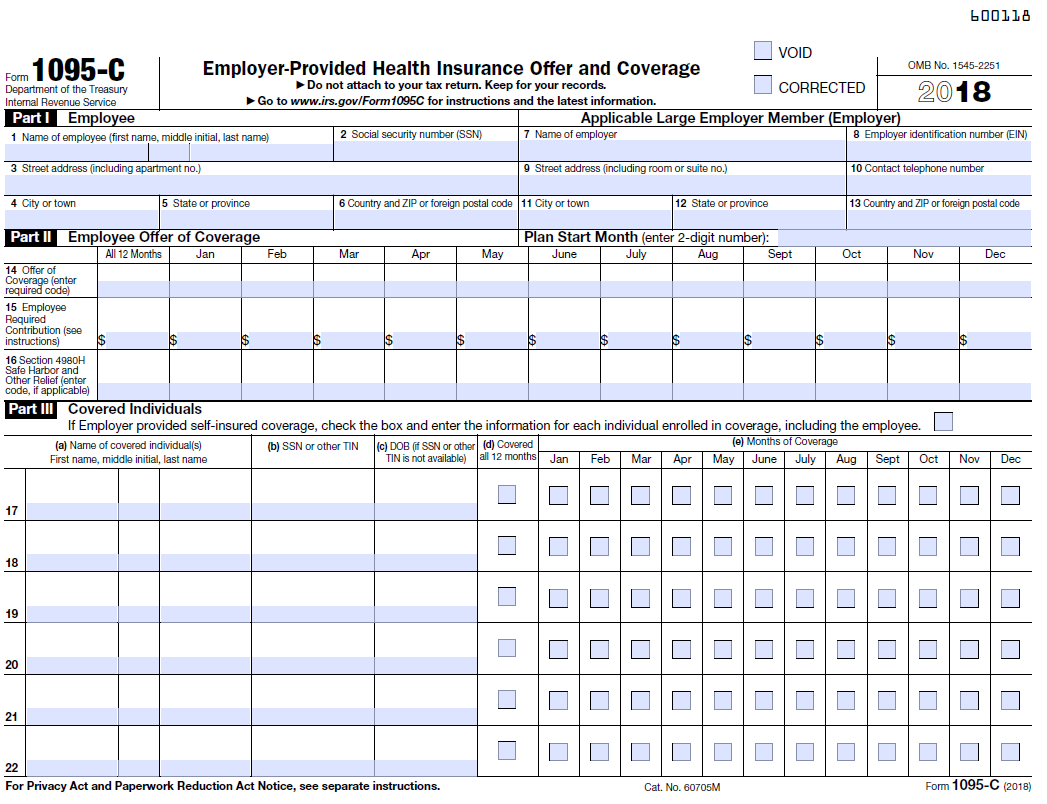

To complete Line 7 13 of Form 1095C, you need the employer information such as Name, SSN, Street address, City, State, Zip Code Employees must report the following on Form 1095C for each employee Offered Coverage;IRS Forms 1094B Learn more about the IRS Form 1094B IRS Forms 1094C Learn more about the IRS Form 1094C IRS Forms 1095B Learn more about the IRS Form 1095B

What Your Clients Need To Know About Form 1095 C Accountingweb

1095-c form instructions 2020

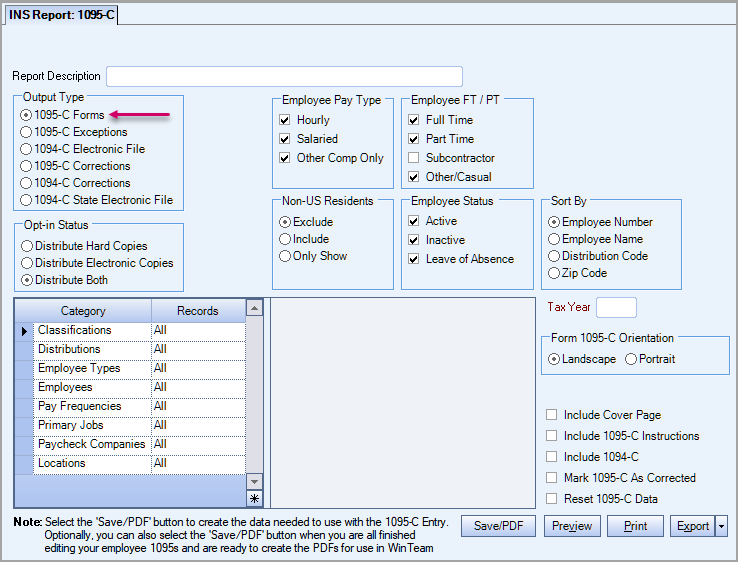

1095-c form instructions 2020-Instructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing;Or you can import ACA form data from the XML efile documents 31 Click the top menu "Current Company" then the sub menu "Form 1095C" to view 1095C screen 32 Click the bottom link "Add 1095 C" to add a new form, enter data and save it IRS Form 1095 C Instructions

Blank 1095 C Full Pg W Instructions B95cperfi05

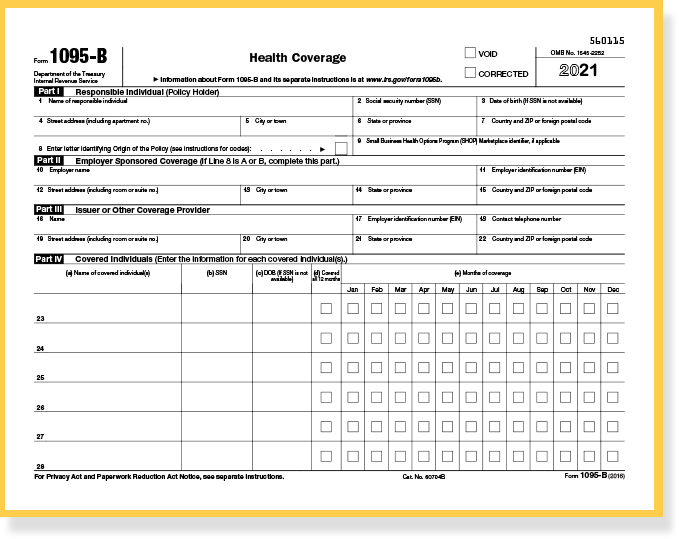

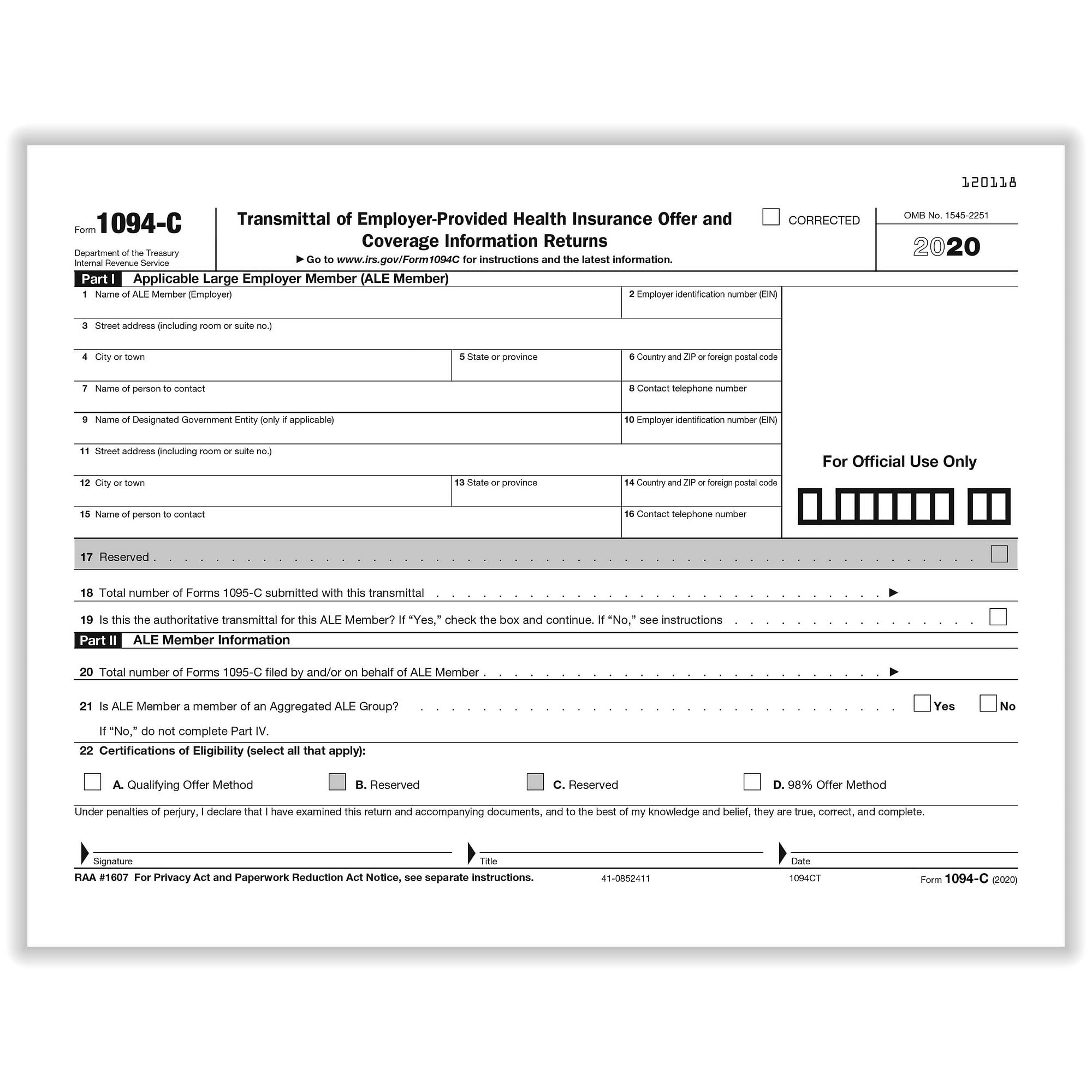

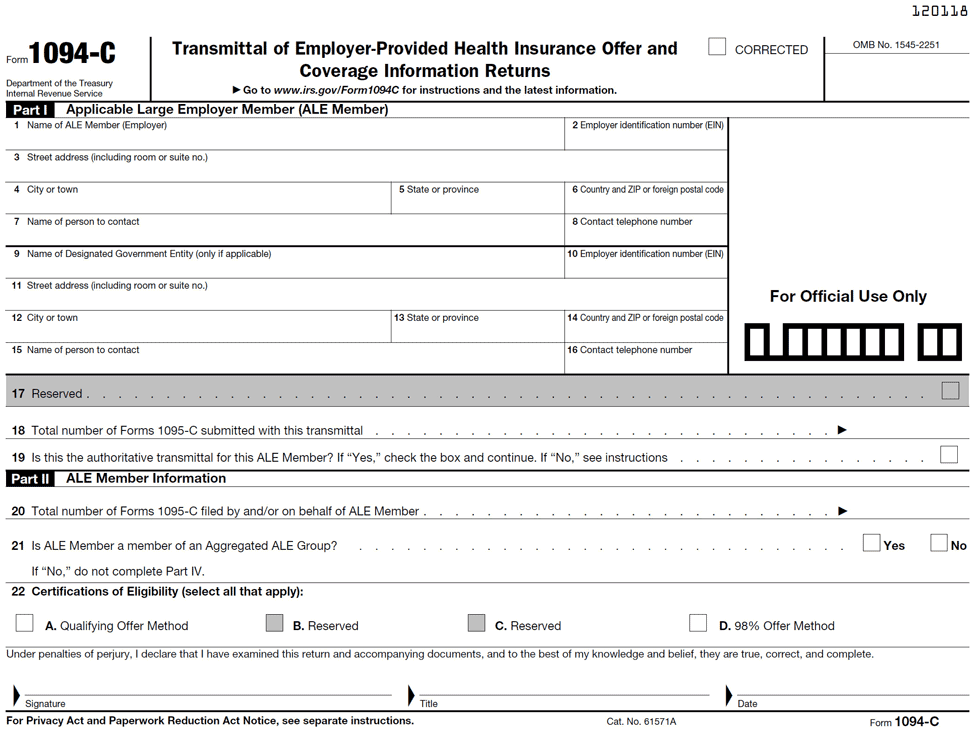

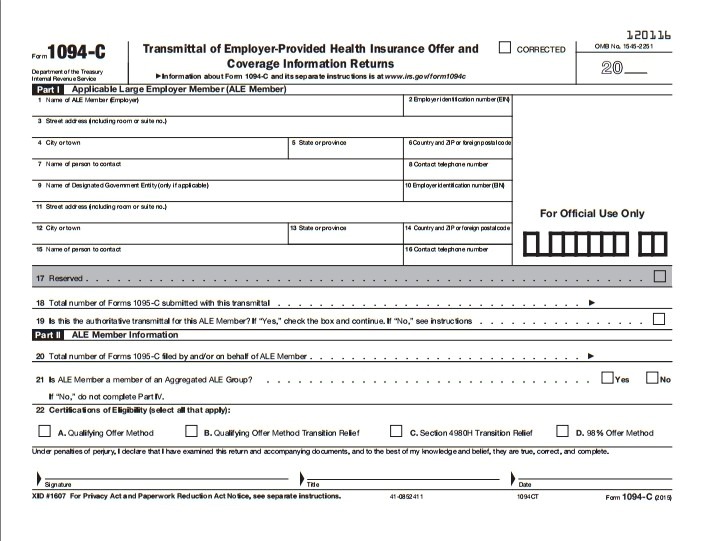

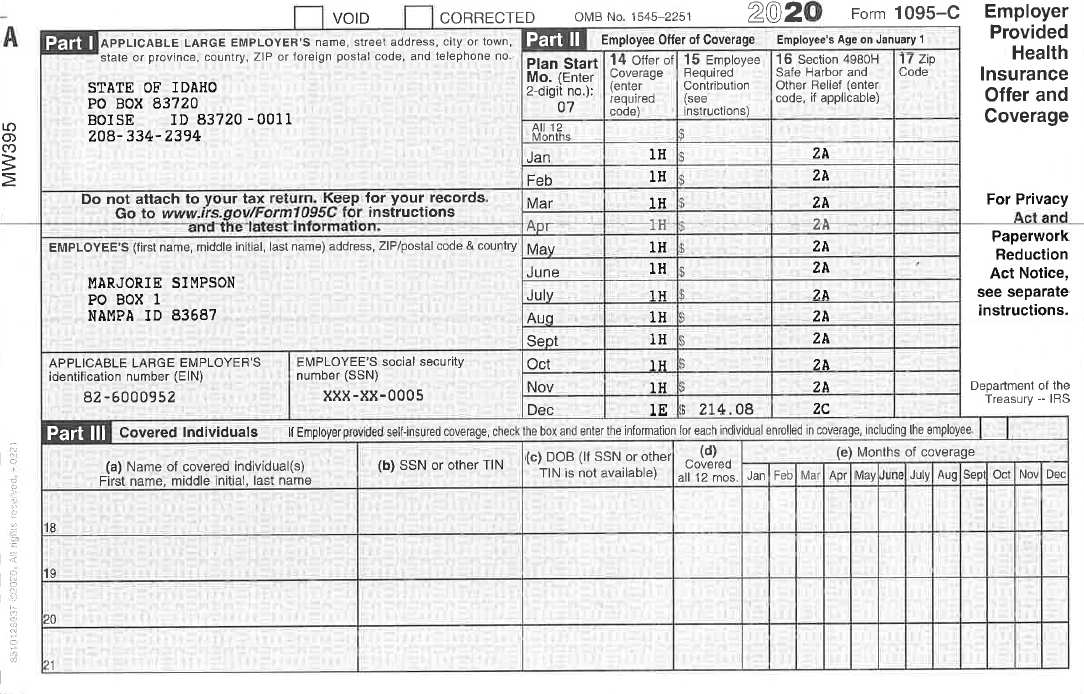

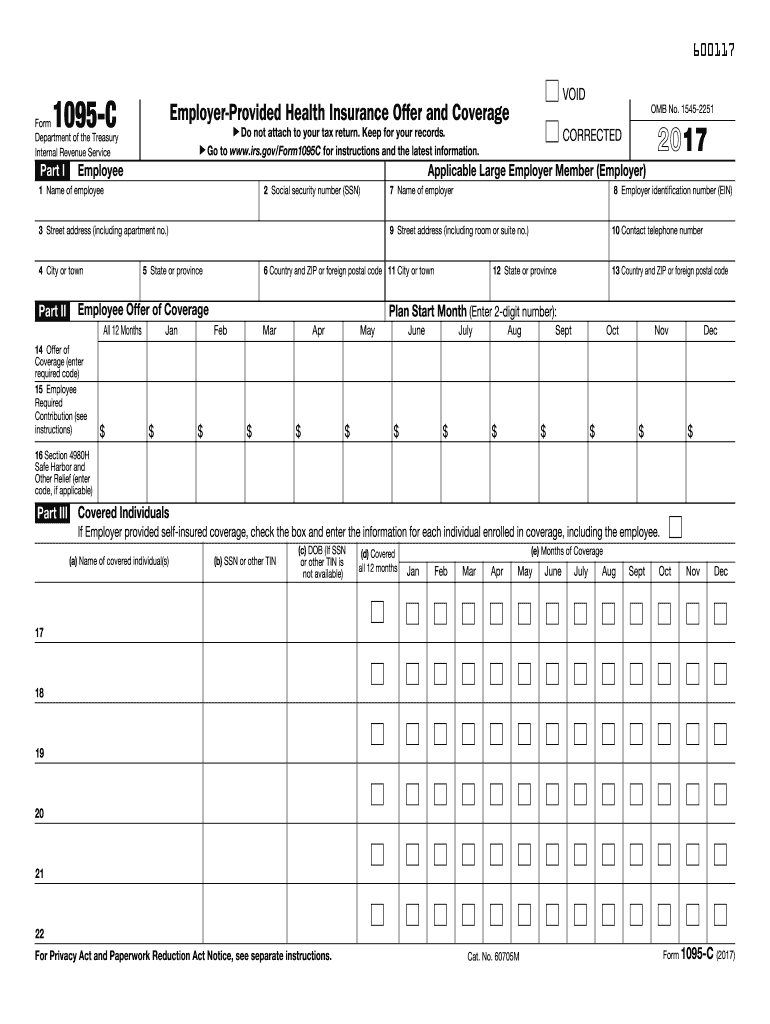

Reporting on Form 1095C The Instructions for Forms 1094C and 1095C contain further information on reporting options for government entities GovernmentSponsored Programs The following governmentsponsored programs are minimum essential coverage 1 Medicare Part A 2 Medicaid, except for the following programs aForm 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C is All Form 1095C Revisions And here are some 1095C pointers Use the 1094C form to tell the IRS about whether you offered workers Minimum Essential Coverage (MEC) You may see the term ALE used in the 1094 and 1095 instructions This means Applicable Large Employer As in an employer who must file the forms

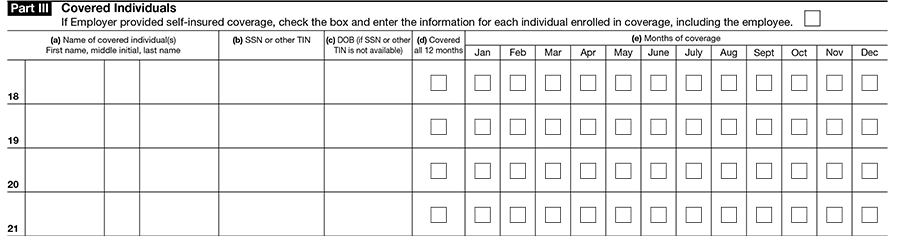

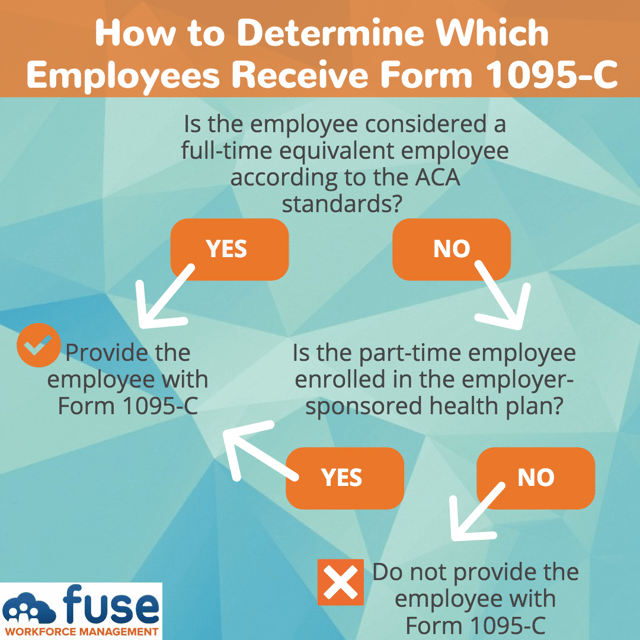

Specific Instructions for Form 1095C Part I—Employee Line 1 Return to top Enter the name of the employee (first name, middle initial, last name) Line 2 Return to top Enter the 9digit SSN of the employee including the dashes Lines 3–6 Return to top Enter the employee's complete address (including apartment no, if applicable)For ALE Members that choose to use Form 1095C to report coverage information for nonemployees enrolled in an employersponsored, selfinsured health plan, see the specific instructions for Form 1095C, Part III—Covered Individuals (Lines 17–22), later Form 1095C may be used only if the individual identified on line 1 has an SSNIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056

The Codes on Form 1095C Explained Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS 1095C Other individuals who have received health coverage provided by their employer should receive this information on Form 1095C, EmployerProvided Health Insurance Offer and Coverage Even if you don't receive a form with this information, you may have had minimum essential coverage for some or all of the yearForm 1095C instructions and general guidelines Here is an overview of the 1095C form IRS that explains what it is, which information the statement contains, and who should file it IRS Form 1095C is a mandatory annual health insurance statement issued by certain employers, namely applicable large employers (ALEs), to their fulltime employees

2

What Your Clients Need To Know About Form 1095 C Accountingweb

1095C, EmployerProvided Health Insurance Offer and Coverage, is an IRS form used by Applicable Large Employers (ALEs) to report information about employee's health coverage Businesses with 50 or more fulltime employees are termed as ALEs Form 1095 C should be filed with the IRS, and copies should be furnished to employeesForm 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageThe information contained on Form 1095C is informational and allows the preparer to verify that the taxpayer and/or their dependents have minimum essential health care coverage Although the Shared Responsibility Payment (or penalty) has been eliminated by the Tax Cuts and Jobs Act starting with the tax year 19 , employees will continue to

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

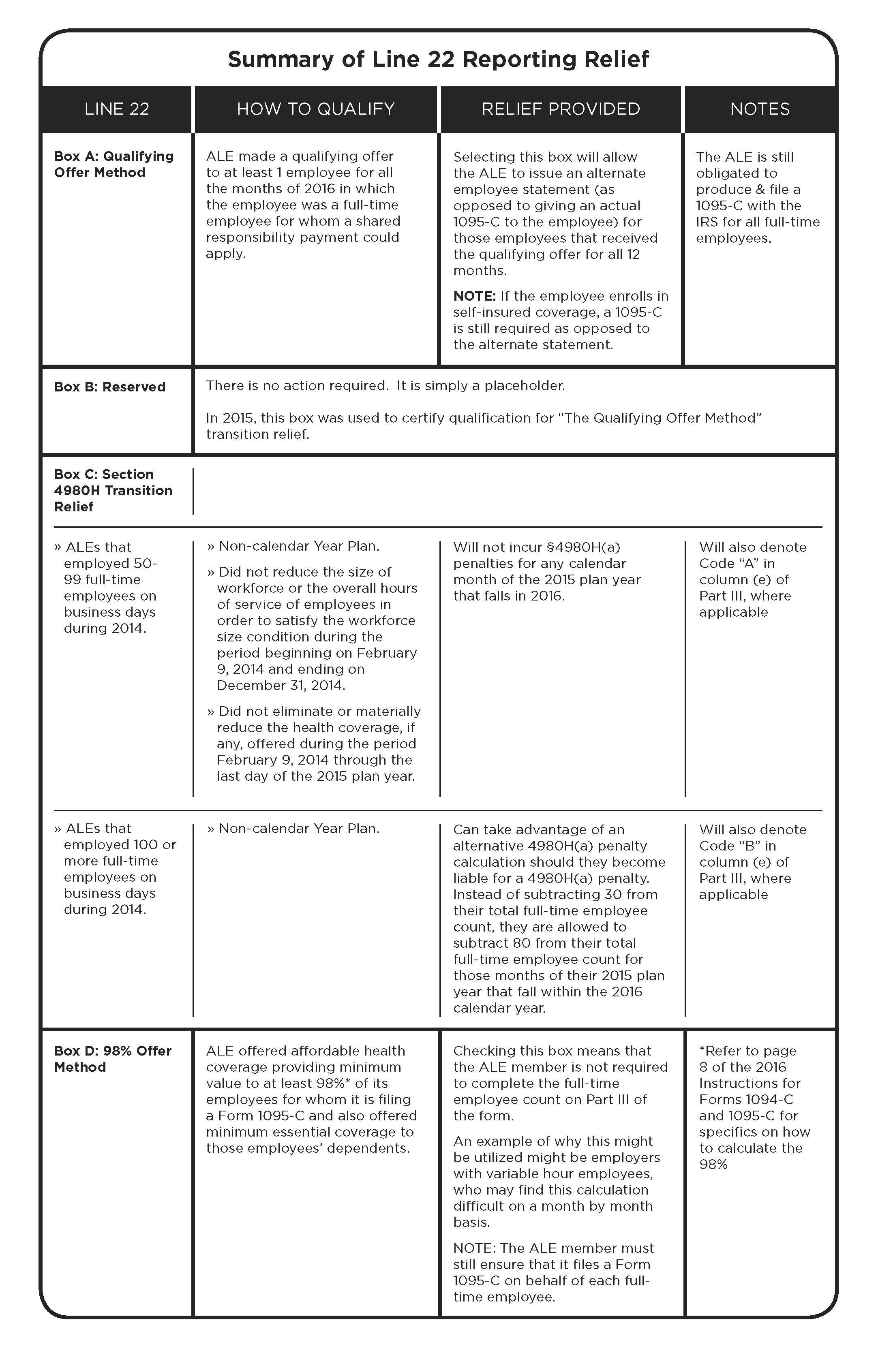

Form 1095C, Part II, the ALE Member must enter code 1G on line 14 in the "All 12 Months" column or in the separate monthly boxes for all 12 calendar months, and the ALE Member need not The number of 1095C forms that are being filed A direct contact The employer, including contact information and the organization's EIN IRS Issues Draft Form 1095C for Filing in 22 In July 21, the IRS released a draft Form 1095C for filing in 22, which applies for coverage held in 21 While the drafts don't include any major 1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)

Benefits 1095 C

.png)

Logo Your Compliance Edge Toggle Navigation Employee Benefits Benefits Notices Calendar Benefits Notices By Company Size Cafeteria Plans Cobra Dental Insurance Dol Audits Educational Assistance Employee Assistance Programs Eaps Erisa

Instructions Tips Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printingThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRSHelp with Forms and Instructions Comment on Tax Forms and Publications Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Blank 1095 C Full Pg W Instructions B95cperfi05

The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, ACA Form 1095C Filing Instructions An Overview Updated 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employeesEnter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving

1095 C Blank Form With Fold Perf And Instructions

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single 1095C must be filed by March 31 of the year following the calendar year to which the return relates Federal Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Extensions – No penalty will be imposed for federal

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

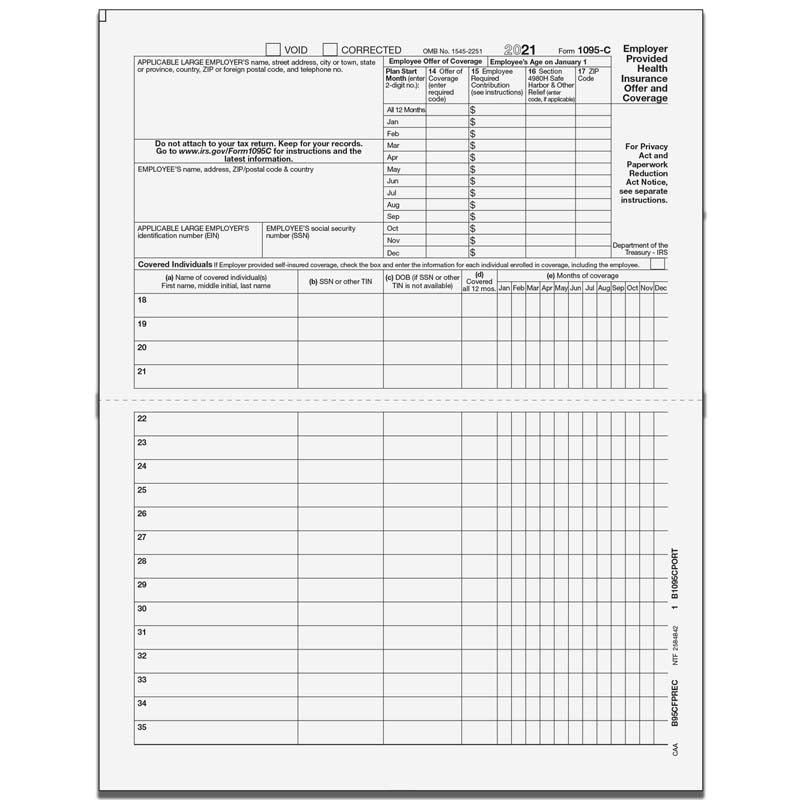

Or you can import 1095C data from spreadsheets;IRS Form 1095C Printable Sample & Detailed Instructions The 1095C form is a filing form that is used to report health coverage to the Internal Revenue Service (IRS) This form is an IRS requirement for those who are selfemployed and are required to provide health coverage to themselves, their spouses, and any of their dependentsEmployee's Age on January 1 (for the tax year filed) Start of the Plan (enter the month) It generally takes between 10 and 15 minutes to file Form 1095C for each employee working for you Here is line by line instructions to file Form 1095C Line 1

Www Irs Gov Pub Irs Prior Ic 15 Pdf

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No 18 Part I Employee 1 Name of employee (f Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by the insurance provider rather than the employerThe Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer of

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Ez1095 Software How To Print Form 1095 C And 1094 C

The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form (s) as a part of your personal tax filingSelect a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsInstructions for Recipient Form 1095C () 6 page 2 In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer's health plan and that plan is a type of plan referred

1095 Software Ez1095 Affordable Care Act Aca Form Software

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Specific Instructions for Form 1095C Part IEmployee Line 1 Line 2 Lines 36 Part IApplicable Large Employer Member (Employer) Line 7 Line 8 Lines 9 and 1113 Line 10 Part IIEmployee Offer of Coverage Plan Start Month Line 14 Indicator Codes for Employee Offer of Coverage (Form 1095C, Line 14) Code Series 1Offer of CoverageFines Associated with Form 1094C and 1095C Compliance Failures For reporting in 21, employers that fail to comply with Form 1094C and 1095C reporting requirements may be subject to fines, including Failing to file carries a $550 fine per return Failing to file electronically when required to do so carries a $270 fine per returnForm 1095C To complete Line 1 6 of Form 1095C, you need the employee information such as Name, SSN, Street address, City, State, Zip Code;

Affordable Care Act Electronic Filing Instructions

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Employer A should file Form 1095C for Employee reporting offers of coverage using the appropriate code on line 14 for January, February, and March, should complete lines 15 and 16 per the instructions, and should include Employee in the count of total employees and fulltime employees reported for those months on Form 1094COn Form 1095A statements furnished to recipients, filers of Form 1095A may truncate the social security number (SSN) of an individual receiving coverage by showing only the last four digits of the SSN and replacing the first five digits with asterisks (*)Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B

1

Irs Form 1095 C Codes Explained Integrity Data

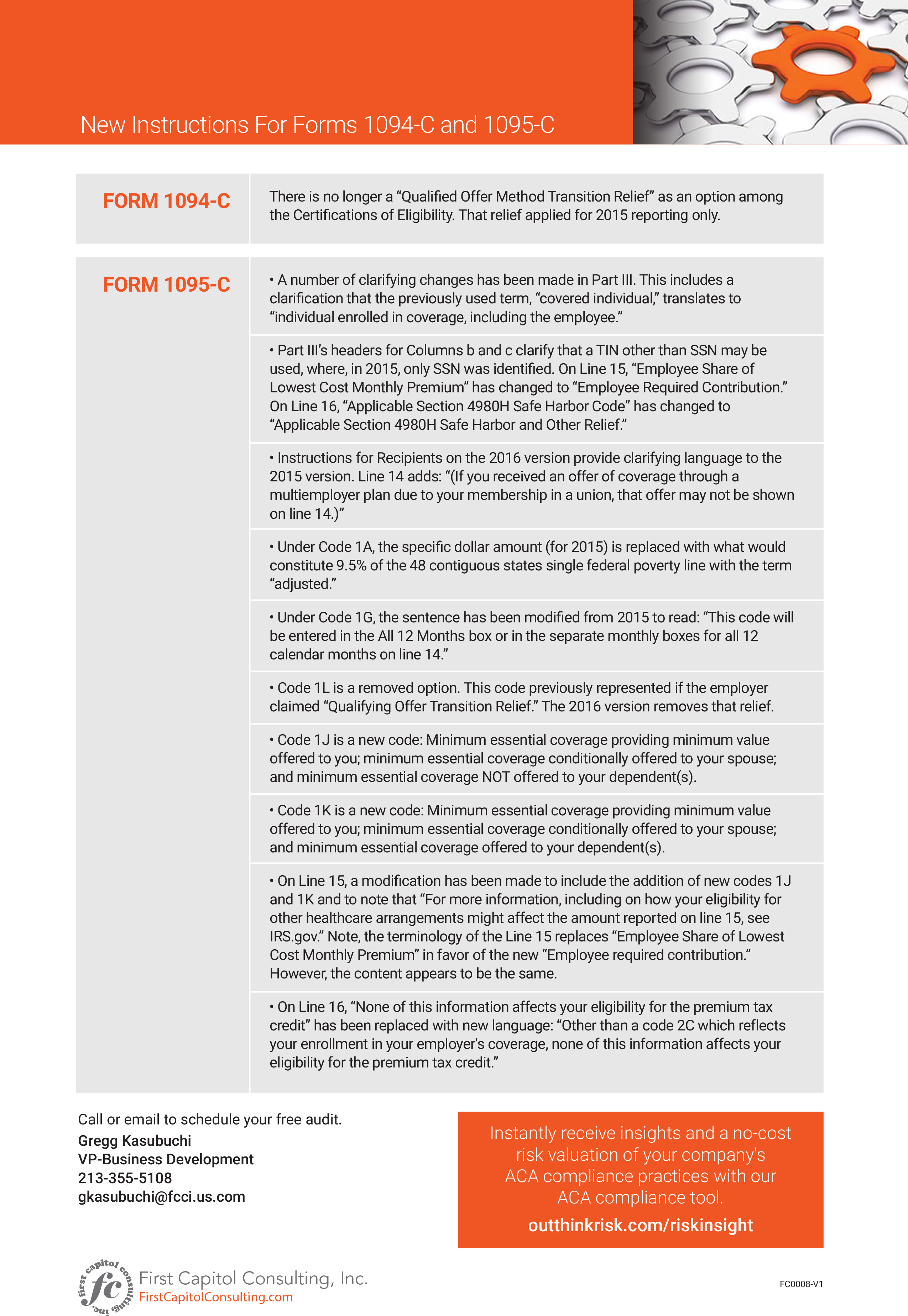

The IRS recently released its draft 1094C and 1095C instructions for the 21 tax year We've identified the changes below It appears that Form 1094C will remain the same, but the instructions do include two new codes for use on Line 14 of the Form 1095C 1T and 1U

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

Form 1095 C Guide For Employees Contact Us

Sample 1095 C Forms Aca Track Support

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Changes In Irs Form 1095 C For Taxbandits Youtube

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Payroll 1095 C Information Affordable Care Act Aca

Form 1095 A 1095 B 1095 C And Instructions

1095 Software Aca Software 1095 Reporting

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

Form 1095 C Forms Human Resources Vanderbilt University

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

News Flash September 5 14 Irs Releases Draft Pay Or Play Informat

1094 C Form Transmittal Zbp Forms

Ins Employee 1095 C Report

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

trix Irs Forms 1095 C

Form 1095 C The Aca Times

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Sample Print Of 1095 B And 1095 C 1095 Software

Instructions For Forms 1095 C Taxbandits Youtube

Preprinted 1095 C Full Page Form W Instructions B95cfprec05

Form 1095 A 1095 B 1095 C And Instructions

Irs Mailing Deadline February 28 Aca Gps

2

1

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs Issues Draft Form 1095 C For Aca Reporting In 21

What Is An Irs Form 1095 C Boomtax

Form 1095 C Instructions For Employers Furnishing Filing

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1095 C Form 21 Finance Zrivo

Irs Form 1095 C Uva Hr

1

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Employer Provided Health Insurance Offer Of Coverage

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

United Benefit Advisors Home News Article

1095 C Form Official Irs Version Discount Tax Forms

1095 C 18 Public Documents 1099 Pro Wiki

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

1094 C 1095 C Software 599 1095 C Software

Www Irs Gov Pub Irs Prior F1095c 18 Pdf

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Form 1095 C Fauquier County Va

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Aca Code Cheatsheet

Http Www Huntonlaborblog Com Wp Content Uploads Sites 14 15 03 Aca Update Irs Issues Final Forms1 Pdf

Sage 50 Peachtree

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Employer Aca Reporting Final Forms Lawley Insurance

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 C Preprinted Portrait Version With Instructions On Back

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Form 1095 A 1095 B 1095 C And Instructions

1095 C Faqs Office Of The Comptroller

Www Hendersonbrothers Com Wp Content Uploads 16 11 New Irs Draft Instructions For 1094 C And 1096 C Forms Pdf

Form 1095 C Instructions For Employers Furnishing Filing

1

What Payroll Information Prints On Form 1095 C To Employees

Changes Coming For 1095 C Form Tango Health Tango Health

Overview Of 1095c Form

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

W H A T I S 1 0 9 5 C F O R M F O R Zonealarm Results

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Irs Form 1095 C Codes Explained Integrity Data

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Form 1095 C Pre Printed Official Irs Form Includes Instructions On The Back

0 件のコメント:

コメントを投稿